What is CP38?

What is CP38?

CP38 is an additional tax deduction issued by LHDN. CP38 requires the employer to make additional deductions in the form of monthly instalments from their employees’ salaries.

This tax deduction is calculated based on the employees monthly taxable income. This income tax deduction based on the Tax Deduction Chart that is issued by the Internal Revenue Board Of Malaysia (IRBM).

What Is The Difference Between PCB And CP38?

CP38 is an instructed salary deduction by the LHDN. CP38 contribution is an addition amount of tax on-top of the PCB contribution amount. CP38 is usually used to settle unpaid income taxes where else PCB is used to reduce the of income tax payable when processing your annual income tax.

What is the purpose of CP38 deductions?

CP 38 was made to lighten the burden of taxpayers who are required to pay tax immediately. By having the employers deduct a portion of their employees’ salary to settle their income tax areas over a certain period of time, the employee will be able to plan their finances appropriately and will not be bombarded with a large sum of deduction during income tax submission period.

The CP 38 only occurs when the IRB issues a specific order requiring the employer to deduction certain amounts for certain months. CP 38 are also used to offset unpaid taxes.

How to submit and pay PCB and CP38?

PCB payment is made using e-CP39 form. e-CP39 is a new method for employers to submit their Monthly tax decisions (MTD) and make payments online. This system is specifically used by the employer who did not have a computerized payroll system.

e-Data PCB is used by companies that have a computerized payroll system. This system allows employer’s to upload the CP39 text file online. Users must register in order to use this system. In e-Data PCB, payment is made using FPX services. The use of e-Data PCB can saves time and simplifies the monthly payroll contribution.

With SQL Payroll Software,

you can auto-generate the CP38 amount easily based on the letter you received from LHDN.

How to Process CP38 in SQL Payroll Software?

Steps to process CP38:

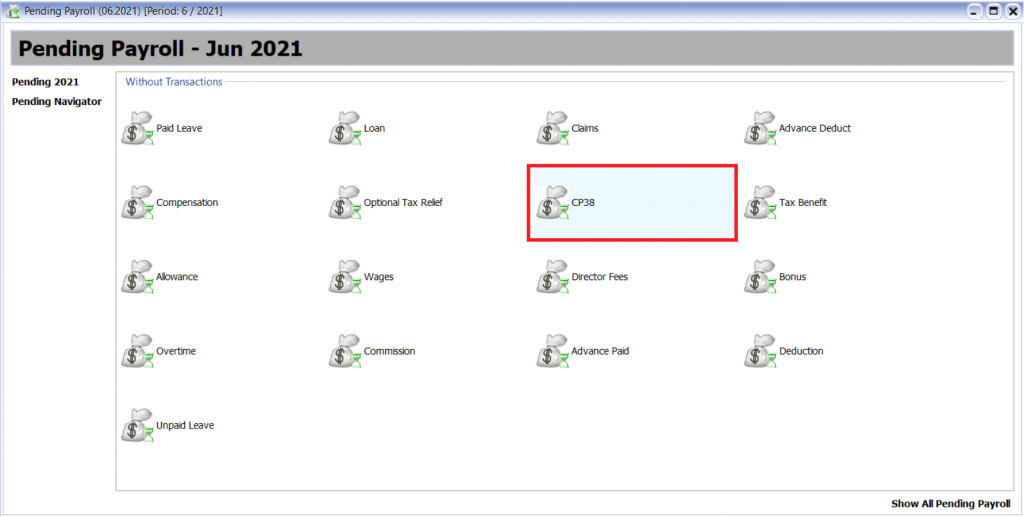

1. Login into your SQL Payroll and go to Payroll > Open Pending Payroll > Select CP38 icon.

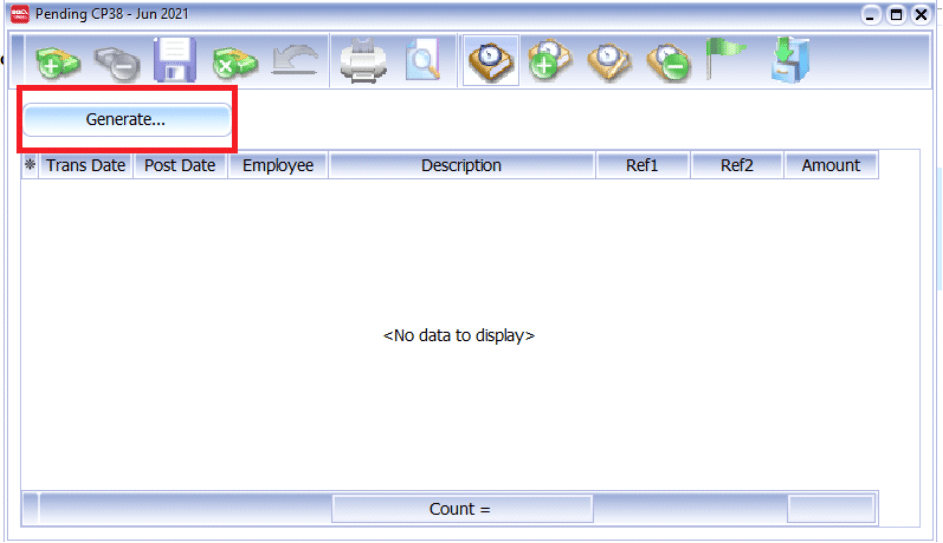

2. Press the generate icon.

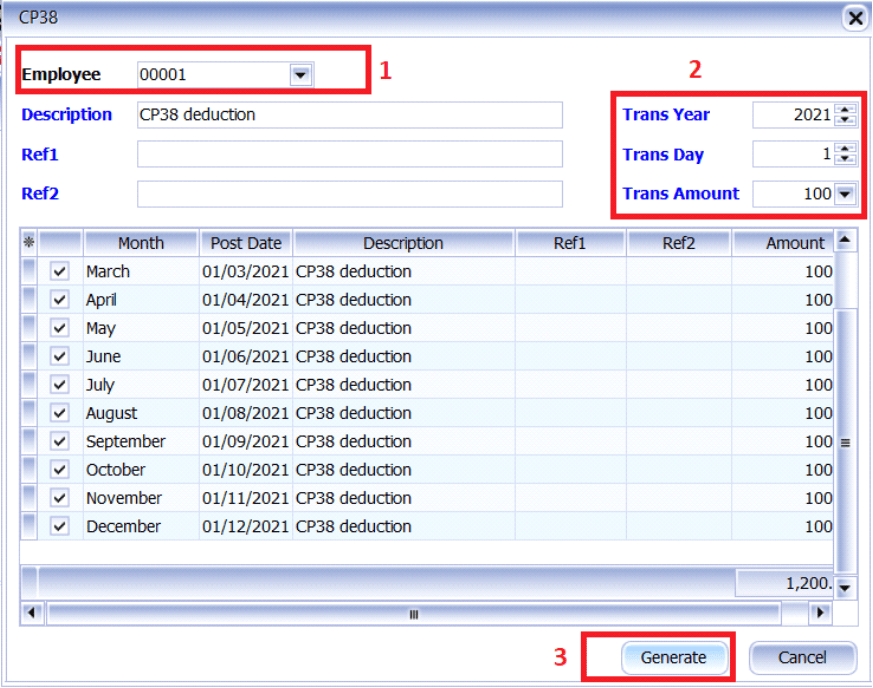

3. Select the employee’s name, set the date, key in the amount ordered by LHDN and tick which months will be affected with CP38.

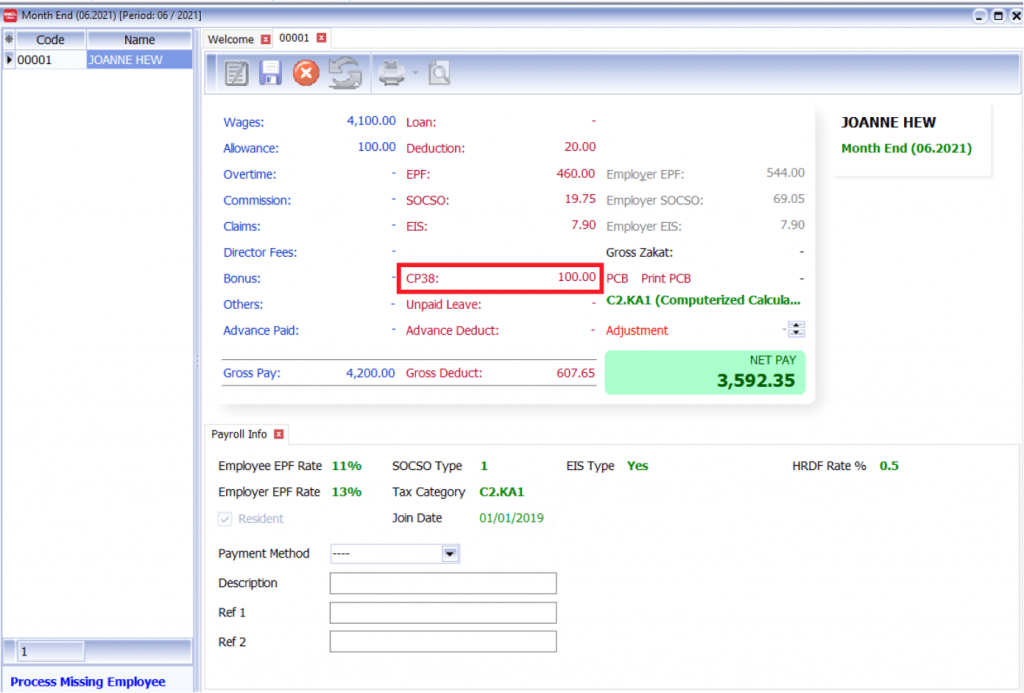

4. Once you process your month end, you will see the CP38 deduction.

How to Submit CP38 in SQL Payroll Software?

Steps to submit CP38:

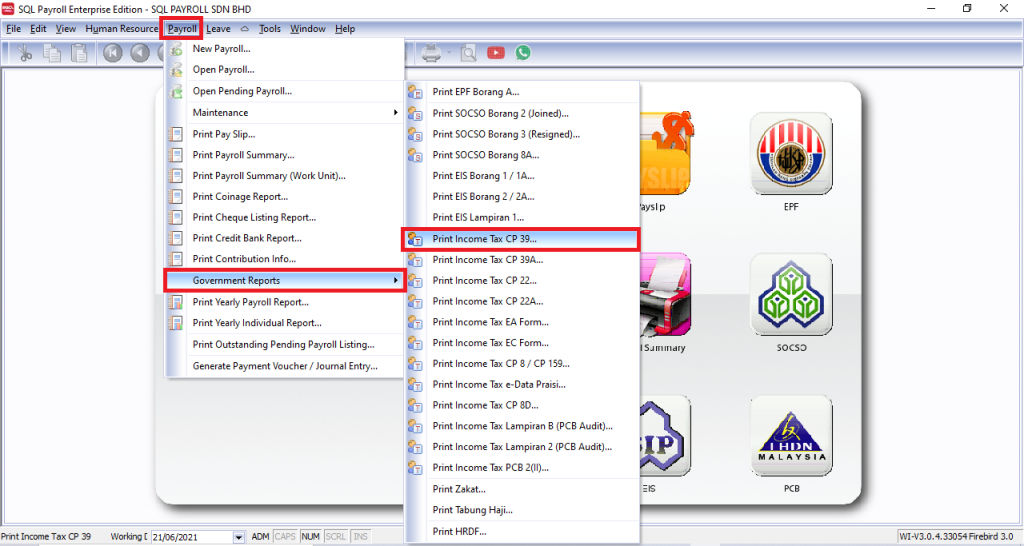

1. CP38 will be submit together with CP39, in the month end payroll, go to Payroll > Government Reports > Print Income Tax CP 39.

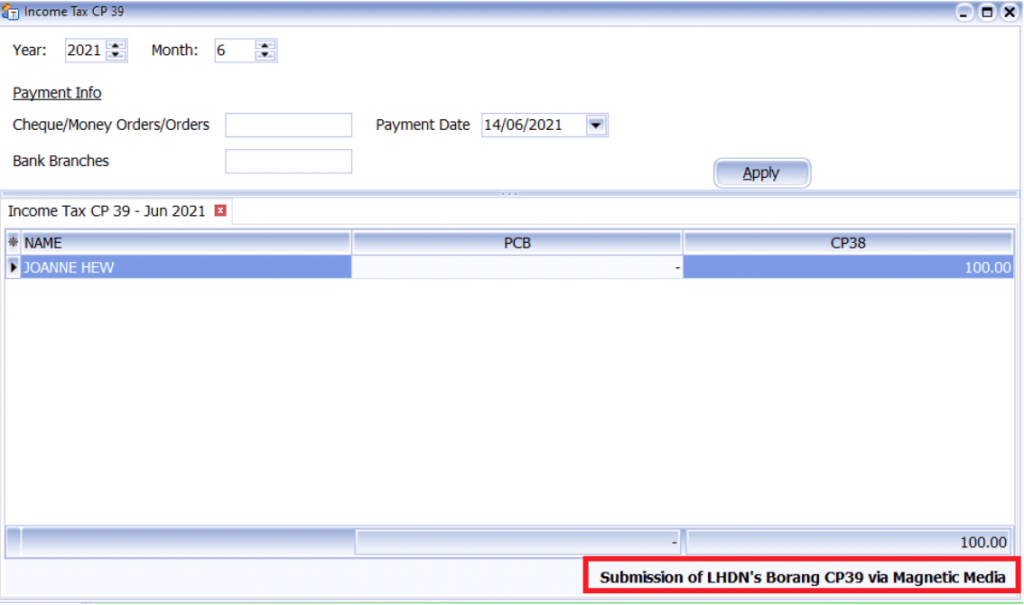

2. Once you see all your employees’ names and PCB and CP38 amount, you can press the black wording “Submission of LHDN’s Borang CP39 via Magnetic Media” at the bottom right of the screen.

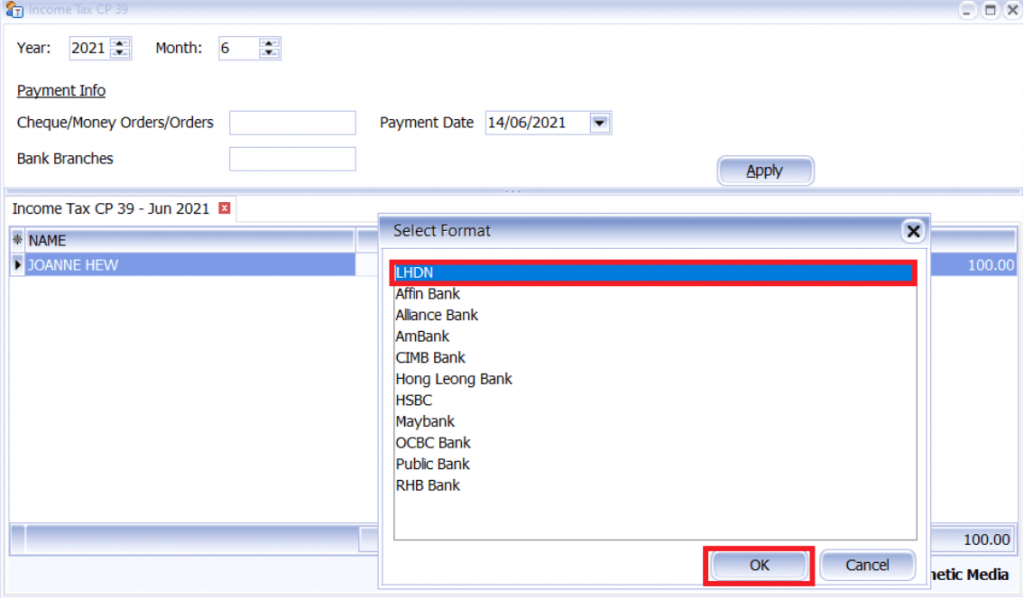

3. Select the LHDN file format & Save the file in your computer.

Tutorial Video

SQL Payroll software Favoured Features

Certified by Statutory bodies & 100% accurate

electronic submission & e-Payment ready

Batch email payslip

Comprehensive management reports

Unlimited year records